what is the percentage of taxes taken out of a paycheck in colorado

The forgiveness of a PPP loan creates tax-exempt income which affects each partners basis in the partnership. For instance if you are hired by an online tutoring company that wants you to tutor a student on your own time you will likely receive 1099-MISC in the following year.

Individual Income Tax Colorado General Assembly

Albeit a sole proprietorship 1099-MISC means that you technically worked for someone else.

. Paycheck Protection Program PPP loans. Finally you might have to figure out how much taxes you have to pay on 1099-MISC income. Partnerships report certain information related to PPP loans.

A partnership can treat tax-exempt income resulting from the forgiveness of a PPP loan as received or accrued 1 as and to the extent that eligible expenses are paid or.

Math You 5 4 Social Security Payroll Taxes Page 240

Individual Income Tax Colorado General Assembly

The Income Tax Rate In Colorado Is 4 63 This Is Not The Only Tax You Will Pay On Your Earnings

/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age

Individual Income Tax Colorado General Assembly

Colorado Sales Tax Calculator Reverse Sales Dremployee

How Do State And Local Sales Taxes Work Tax Policy Center

Colorado Paycheck Calculator Smartasset

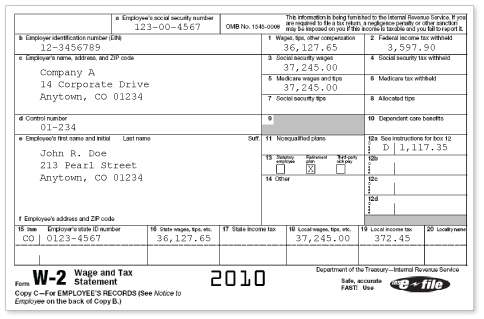

State W 4 Form Detailed Withholding Forms By State Chart

How Much Tax Is Taken Out Of My Paycheck In New Brunswick Cubetoronto Com

Understanding Your Paycheck Stub Information Earnings Deductions How To Read Your Pay Stub Iris Fmp

Individual Income Tax Colorado General Assembly

Here S How Much Money You Take Home From A 75 000 Salary

2022 Federal State Payroll Tax Rates For Employers

What Percentage Of Taxes Are Taken Out Of Paycheck In Nova Scotia Cubetoronto Com

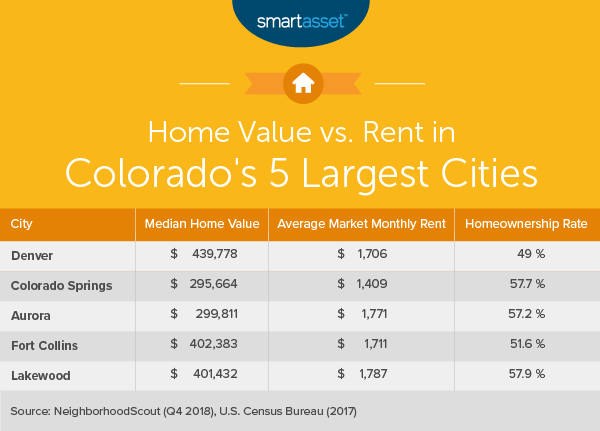

The Cost Of Living In Colorado Smartasset

Colorado Paycheck Calculator Smartasset